Help & FAQs / Tax

Where can I find my tax forms?

Log into your CoinList account, navigate to Account > Tax Documents > Click the link to download your document(s).

If you do not have any documents available you will see the following message: "There are no tax documents available from CoinList at this time. If you are a U.S. person or entity, we will notify you via email if and when additional documents become available".

Other Tax Questions

Who is TaxBit and how can they simplify Form 8949?

If you are interested in assistance with the forms described above, TaxBit and CoinList have joined forces to streamline the process of generating Form 8949. TaxBit will automate the process and provide a single aggregated view of all your CoinList cryptocurrency transactions and balances in one place.

The completed forms including synced transactions will be available for download through TaxBit and can be used when filing your tax return. Built by CPAs, tax attorneys and developers, TaxBit calculates the cost basis and corresponding gains or losses on every transaction. A full-audit trail will be provided so that users, accountants, and auditors can drill down into any transaction to see exactly how the gain or loss was calculated. TaxBit will not file your tax return for you. Please consult with your tax advisor. Learn more about TaxBit.

CoinList does not provide tax advice and the information presented is not intended to be relied upon as advice concerning the appropriate treatment or possible tax consequences of any transaction. Please consult with your tax advisor. This article contains references to information obtained from third-party content providers (content hosted on sites unaffiliated with CoinList). As such, CoinList makes no representations whatsoever regarding any information obtained from third parties that may be referenced directly or indirectly in this article.

What is the US tax form 1099-B and what do I do with it?

The US tax form 1099-B provides transactional information detailing capital gains and losses from disposing of capital assets. At this time, cryptocurrency is classified and treated as property.

When you sell something for more than it cost you to acquire it, the profit is a capital gain and may be taxable. On the other hand, if you sell something for less than you paid for it, then you may have a capital loss and a reduction of your taxable capital gains or other income is possible.

- The transactional details found on your 1099-B are used to fill out your IRS 8949.

- A summary of the capital gains or losses from these transactions are reported on Form 1040 (Schedule D) of your tax return.

Your CoinList Form 1099-B will detail each asset you sold throughout the year with CoinList and report your cost basis, when available, for the assets you bought and sold on the platform.

What is the US tax form 1099-MISC and what do I do with it?

For U.S. taxpayers, the IRS requires companies that make certain types of payments to provide the recipient of such payments and the IRS with a 1099-MISC. This form provides information for a wide range of income payments such as crypto interest, referral bonuses, and other income.

- For US clients, if you’ve earned $600 or more this year in crypto interest and bonuses, the 1099-MISC form will be made available to you by January 31, 2023.

- U.S. taxpayers will need to report this income within their tax filing.

What is US tax form 8949?

The IRS requires that details of cryptocurrency transactions that qualify as a gain or loss to be reported on Form 8949, “Sales and Other Dispositions of Capital Assets”.

Will CoinList provide me with a 1099-MISC?

CoinList will provide you with a Form 1099-MISC. This form reports to you and the IRS any income generated from activities such as airdrops, staking, referrals, etc. in excess of $600.

How do I complete form 8949 using the form 1099-B?

Understanding Form 1099-B and 8949

CoinList is on a mission to make cryptocurrency taxes as seamless as possible. CoinList provides all users that incurred a taxable disposition with a 1099-B, which itemizes all known taxable transactions. Similar to traditional equities, taxpayers are responsible for transposing the information on the 1099-B onto an IRS 8949. CoinList has partnered with TaxBit to automate and simplify the process of transposing your 1099-B onto your IRS 8949. Whether you only traded on CoinList, or you traded on multiple exchanges, completing your crypto taxes has never been easier.

This guide explains how to transpose your 1099-B onto your IRS 8949.

CoinList Was the Only Exchange I Traded On

If all of your assets were acquired and stored on CoinList’s platform then your 1099-B will be complete. The 1099-B provides you with all of your taxable events and can be directly transposed onto your IRS 8949 and filed. CoinList provides a courtesy copy of the IRS 8949 if all of a user’s acquisition information is known.

I Traded On Multiple Exchanges

If you acquired cryptocurrency on a third-party platform and transferred assets onto CoinList then your acquisition information may not be known. It is your responsibility to enter your acquisition information on IRS Form 8949 for assets that were acquired on another platform and were subsequently disposed of on CoinList. You will complete two IRS 8949’s. One that includes your known cost basis transactions and another for transactions that were missing cost basis.

Transpose Known Cost Basis Onto IRS Form 8949

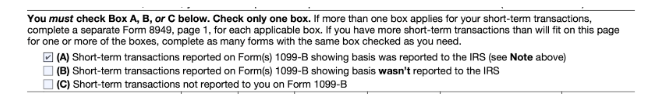

The first step is to transpose transactions that have a known cost basis onto your IRS 8949. You will check box “A” for these transactions because cost basis information is known on Form 1099-B.

Transpose Missing Cost Basis Transactions on Seperate Form 8949

If a transaction is missing acquisition information then you will transpose the transactions onto a separate IRS 8949 tax form. You will check box “B” indicating that the acquisition occurred off platform and therefore was not reported on the 1099-B.

Methods to Completing IRS 8949

There are two methods to filling in missing cost basis information and completing your IRS 8949’s: 1) link your TaxBit account; or 2) manually enter the information.

(i) Link TaxBit Account (Recommended)

The easiest way to complete your IRS 8949 is to link your TaxBit account. TaxBit has a seamless integration with CoinList, as well as over a hundred other exchanges, allowing you to aggregate your trading activity across platforms. TaxBit automates the process of transposing your 1099-B onto an IRS 8949. Missing cost basis transactions that were acquired off of CoinList’s platform will automatically populate and your IRS 8949 tax forms can be downloaded from your account.

(ii) Manually Enter Information

You can also solve missing cost basis information by manually entering the information on your IRS 8949’s. When manually filling-in missing cost basis information it is important to keep detailed records to substantiate the information reported.

Conclusion

CoinList is committed to making crypto taxes as simple as possible. To automate the process, all CoinList users are eligible for 10% off of their TaxBit plan: https://taxbit.com/invite/CoinList/.

Disclaimer: CoinList does not provide tax advice and the information presented is not intended to be relied upon as advice concerning the appropriate treatment or possible tax consequences of any transaction. Please consult with your tax advisor. This article contains references to information obtained from third-party content providers (content hosted on sites unaffiliated with CoinList). As such, CoinList makes no representations whatsoever regarding any information obtained from third parties that may be referenced directly or indirectly in this article.

Will CoinList provide me with a 1099-B?

CoinList will also provide you with a Form 1099-B. This form reports to you all taxable cryptocurrency transactions (for example, sell for fiat or crypto-for-crypto trade) and corresponding proceeds, cost basis where available, and resulting gain/(loss) information for each taxable transaction. More information on cryptocurrency transactions can be found here.